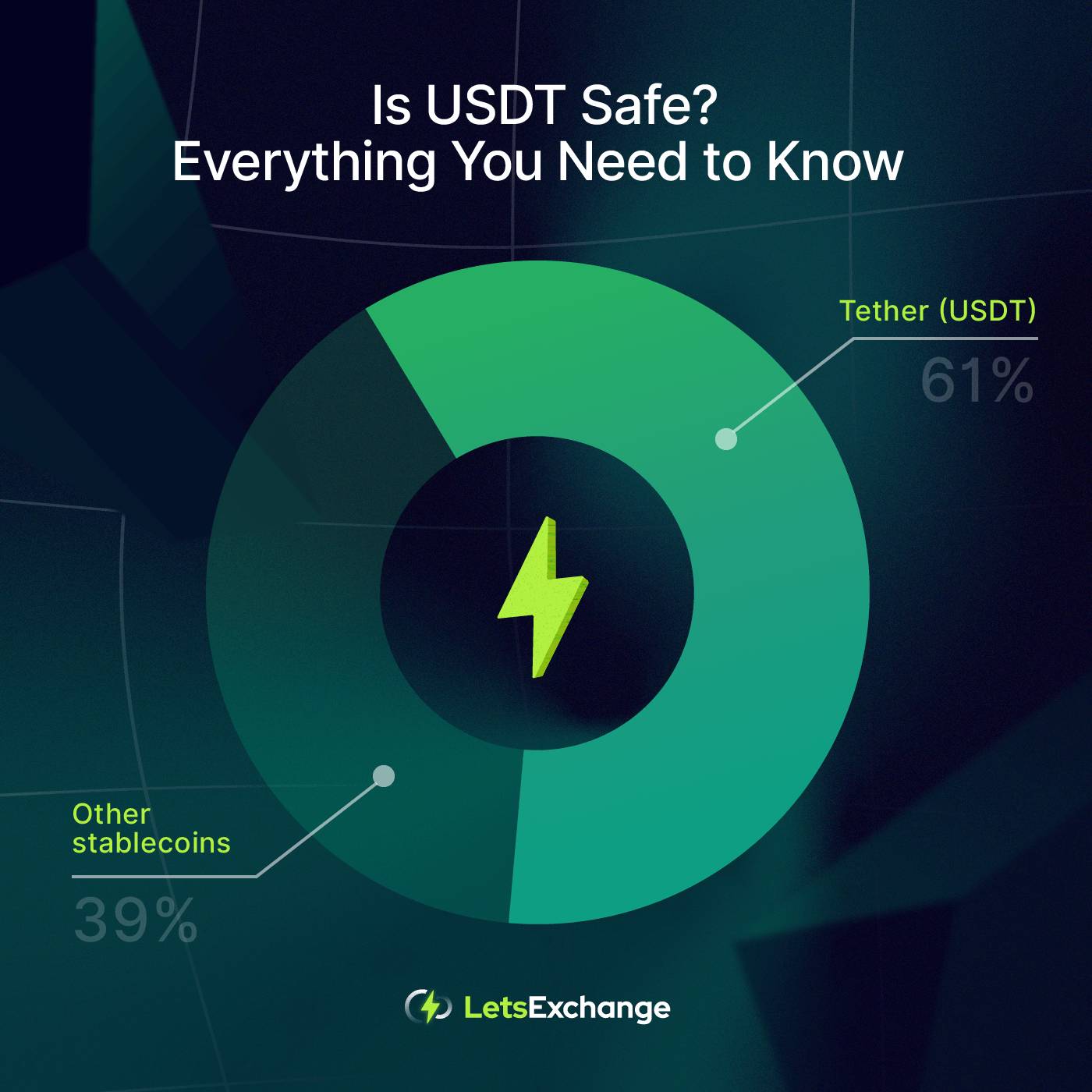

Tether is one of the biggest cryptocurrencies in the world and the biggest stablecoin by market capitalization. As for November 18, 2021, the stablecoin market looked like this:

The Tether domination in the market of stablecoins is evident. Nevertheless, many investors believe that investing in Tether might not be the wisest decision. While some specialists believe that recent trust-related issues with Tether might influence not only the coin’s future but the future of the entire cryptocurrency world in an unpredictable way, others insist that Tether means stability.

What Is Tether?

Tether is a cryptocurrency, just like Bitcoin, Ethereum, etc. But it differs from typical cryptocurrencies significantly. Tether is a stablecoin. Its price is pegged to the USD price. One Tether values approximately 1 USD while cryptocurrencies that are not stablecoins are volatile. Their prices change drastically over short periods of time.

How does Tether manage to keep its price stable? Every Tether token is backed by a US dollar held in a special bank account. A new Tether coin can be created only when 1 USD is added to the account. This is how it shall work to be efficient.

However, the recent issues faced by the stablecoin demonstrated that not everything is as smooth as it shall be. While the stablecoin was created to facilitate trading, lending, and money transfers, the lack of transparency around it has raised some doubts. While Tether was trying to address the concerns by publishing their attestation report, it was revealed that some issues exist.

Tether is Backed by 3.9% in Cash Reserves

The idea behind the stablecoin was to be 100% backed by USD. But the attestation revealed that just 3.9% of Tether is backed by cash. 65.4% is backed in commercial papers. Commercial papers represent a type of short-time loan made to corporations. Tether doesn’t share any information about the type of the loan nor about the borrowers. It is also unknown whether it is easy for Tether to access that money.

Another concern is connected with the audit itself. It was performed by accounting firm Moore Cayman but it was not a full independent audit.

Tether, while confirming that every coin is backed, doesn’t insist now that it is backed with USD.

Tether Has Had Legal Troubles

BitFinex, the parent company of Tether, has had issues with the New York Attorney General’s Office. After a long investigation, BitFinex was fined for 18.5 mln USD and was banned from performing operations in New York.

BitFinex denies any breaches against the regulation. But since then, investors’ confidence in Tether has diminished.

What Is Going on with Tether?

It would be better to ask somebody from the company, isn’t it? So, here is how Tether CTO Paolo Ardoino (He is also BitFinex CTO) and Tether’s general counsel Stuart Hoegner explain the situation around Tether.

The interview highlights are:

- Tether isn’t going to share any information about commercial papers that back up the currency.

- They have never denied a single customer who wants redemption.

- They do not deny that commercial papers are Chinese.

- Tether is working toward financial audits.

Tether Has Impact on the Market

Many specialists, including JPMorgan’s analysts, believe that Tether is not a stability guarantor as it is supposed to be. On the contrary, it is considered a potential threat to financial stability.

Tether is used by traders to keep their crypto funds safe during high volatility periods in the crypto market. The stablecoin allows keeping the funds safe without swapping them to fiat. Therefore, among traders, there are a lot of Tether holders.

If the trust in Tether decreases, USDT holders might start selling the stablecoin or requesting a redemption. It would not be an issue if Tether were backed by USD. But Tether is backed with commercial papers. That’s why specialists doubt that the Tether network can compensate its holders each USDT if the holders wish to sell their USDT coins. For now, there have been cases when USDT holders asked for redemption, and they got it even though not immediately.

Also, Tether operates like any bank or financial institution. But it is not regulated and doesn’t provide the same guarantees as a bank or a financial institution would provide. It is one more concern raised by market analysts. Now, stablecoins, especially Tether, comprise a big part of the cryptocurrency world. If stablecoins collapse, the entire ecosystem might collapse or be damaged severely.

Tether Is Not the Only Stablecoin

USDT is the biggest stablecoin based on the market cap. This stablecoin is involved in more than half of Bitcoin trades worldwide. However, USDT is not the only stablecoin. If Tether fails, its failure will impact the entire market. But it will be beneficial for stablecoins that are 100% backed by USD. Gemini USD and GTBC would definitely become leaders.

What Is Going to Happen Further?

It depends. There is a high possibility that regulation will change. How the Tether position changes, will depend on the regulation.

One of the possible ways to move Tether and other stablecoins from the market is to create a digital dollar. Its creation would make stablecoins unnecessary. A digital dollar is the main risk to Tether’s future even though Tether’s creators do not agree with it. They insist that even if a digital dollar is created, there will be enough space for all stablecoins.

For now, the argument is going on. While Tether is trying to recover its positions and regain the trust of users, stablecoins attract the increasing attention of authorities.