“Listing” is a term we currently use in cryptocurrency exchanges. An exchange lists a crypto asset when it offers trading pairs for the said coin or token. Listing expresses trust in a project and its associated crypto asset. Being listed by a major exchange like Binance or Coinbase can represent a significant boost to a cryptocurrency’s price and market capitalization. The largest exchanges usually list coins and tokens with sufficient liquidity in each trading pair to ensure an accurate price discovery.

The opposite, “delisting,” is the removal of a crypto asset from an exchange. Sometimes, delisting happens when the project’s team requests the removal of their token or coin. However, in most cases, an exchange delists a cryptocurrency when it no longer meets the predefined listing requirements. Some factors that can lead to the delisting of a crypto asset are:

- Development team’s lack of commitment to the project,

- Poor project development,

- Network instability,

- Smart contract instability,

- Lack of communication with the project’s community,

- Unresponsiveness to diligence requests from the exchange,

- Fraudulent or unethical activity.

An exchange can consider many other factors to delist an asset. For instance, Binance also considers trading volume, liquidity, risk profile, and public behavior.

The Fate of Delisted Tokens and Coins

When an exchange delists a cryptocurrency, it removes all trading pairs associated with that coin or token from its platform. It means users can no longer trade the asset on that specific exchange. In most cases, the delisted cryptocurrency's withdrawal is possible for a specified time after the delisting. This way, users do not lose their funds even if trading of the delisted asset ceases on the exchange. Note that the delisted cryptocurrency might be traded on other exchange platforms.

However, just like being listed by a major exchange can boost a cryptocurrency’s market cap, being delisted can depreciate a coin or token. For instance, Binance.US, the American arm of the exchange Binance, announced the TRON (TRX) and Spell Token (SPELL) delisting on April 10, 2023. One day after the announcement, the TRON price fell nearly 5%, whereas the SPELL price fell more than 5%. Both tokens were removed from that exchange on April 18, 2023. Binance.US said this delisting resulted from a periodic review.

Can Delisted Cryptocurrencies Rise in Price Again?

While being delisted from a major exchange can be detrimental to a cryptocurrency’s price, such an event does not necessarily mean the end for that asset. Usually, not all exchanges delist a cryptocurrency at once unless this crypto asset crashes (like UST/LUNA) or is proven to be a fraud. The largest exchanges usually have stringent listing requirements, which emerging cryptocurrencies find challenging to meet. Nevertheless, it does not mean a digital asset is worthless because it cannot remain listed on a major exchange platform.

Instant and decentralized exchanges are commonly friendlier to new cryptocurrencies in the market. These platforms usually have more accommodating listing requirements that allow crypto users to continue to trade delisted assets on major exchanges. Some of these delisted cryptocurrencies can eventually recover and increase their price after some time. Let us review some examples, starting with the two tokens delisted by Binance.US mentioned above.

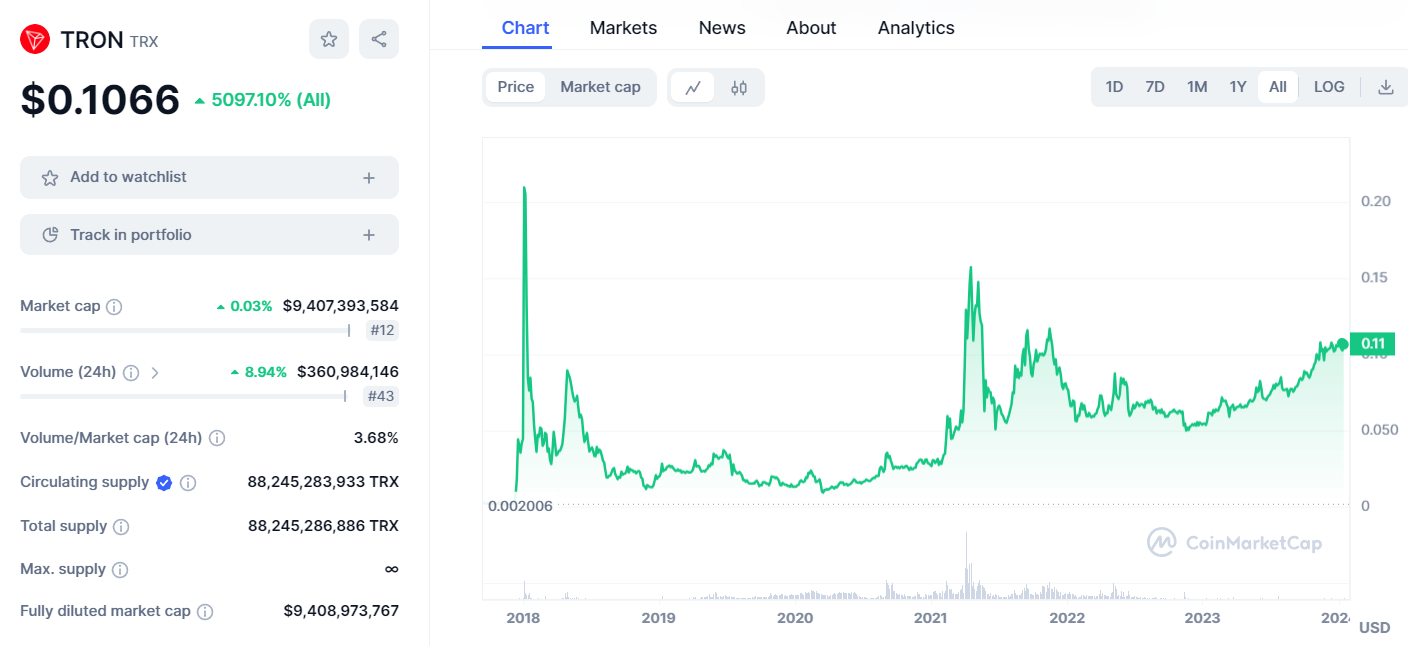

1. TRON (TRX)

TRON is a network that aims to further the decentralization of the Internet. The TRX token is the native token of the TRON network. After its launch in September 2017 and the release of its mainnet in May 2018, TRON has had excellent performance throughout the years. But on April 11, 2023, one day after Binance.US announced it would delist TRON, the TRX price dropped. But as seen in the graphic below, the delisting affected the TRX price until the end of April 2023. During the first days of May, the TRX price is rising again.

2. Spell Token (SPELL)

This digital asset is a reward token associated with abracadabra.money, a lending platform using interest-bearing tokens (ibTKNs) as collateral to borrow a stablecoin known as Magic Internet Money (MIM). As with TRX, the SPELL price significantly dropped on April 11, 2023, following the announcement of delisting from Binance.US. As seen in the graphic below, the SPELL price has been on a downtrend since the delisting on April 18. Is this token doomed? Not necessarily.

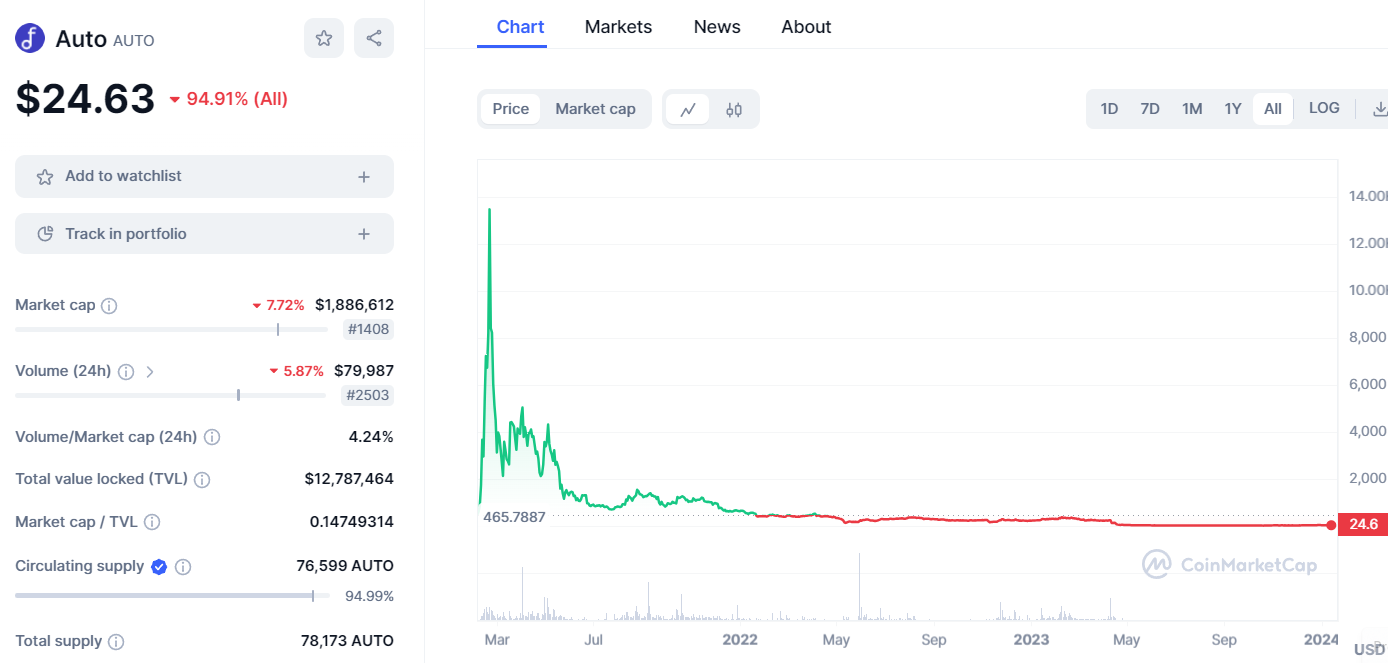

3. Auto (AUTO)

AUTO is the native token of the Autofarm protocol, a cross-chain yield aggregator platform launched in December 2020. Once the largest yield aggregator on the BNB Chain, AUTO suffered a significant depreciation. Its market cap went from nearly $200 million in February 2021 to less than $20 million during almost all of 2022. On April 11, 2023, one day after Binance announced it was delisting this token, the AUTO price dropped sharply. AUTO’s market capitalization was less than $2 million as of May 9, 2023. Although this project clearly had problems, the delisting from Binance contributed to a faster depreciation.

The Bottom Line

Being listed on the largest exchanges worldwide can tremendously boost a cryptocurrency’s market capitalization. Hence, being delisted from such platforms could be a significant blow to a cryptocurrency’s development plans. Although, in most cases, a cryptocurrency’s price suffers due to delisting, that is not necessarily the end of this digital asset. Cryptocurrencies with a sound project behind them usually recover from a delisting and increase their price eventually. Others do not make it after a delisting. The examples reviewed in this article are cryptocurrencies delisted from the major exchange Binance. However, they are still listed by LetsExchange.io.

Disclaimer

Please keep in mind that the above information is based exclusively on our observations and is provided for informational purposes only. It doesn’t constitute any kind of financial advice nor represents an official forecast. Cryptocurrency is a highly volatile asset, and you are investing in it at your own risk.